01 Apr April 1st Deadline – Is it time to pay sick and family leave to your employees?

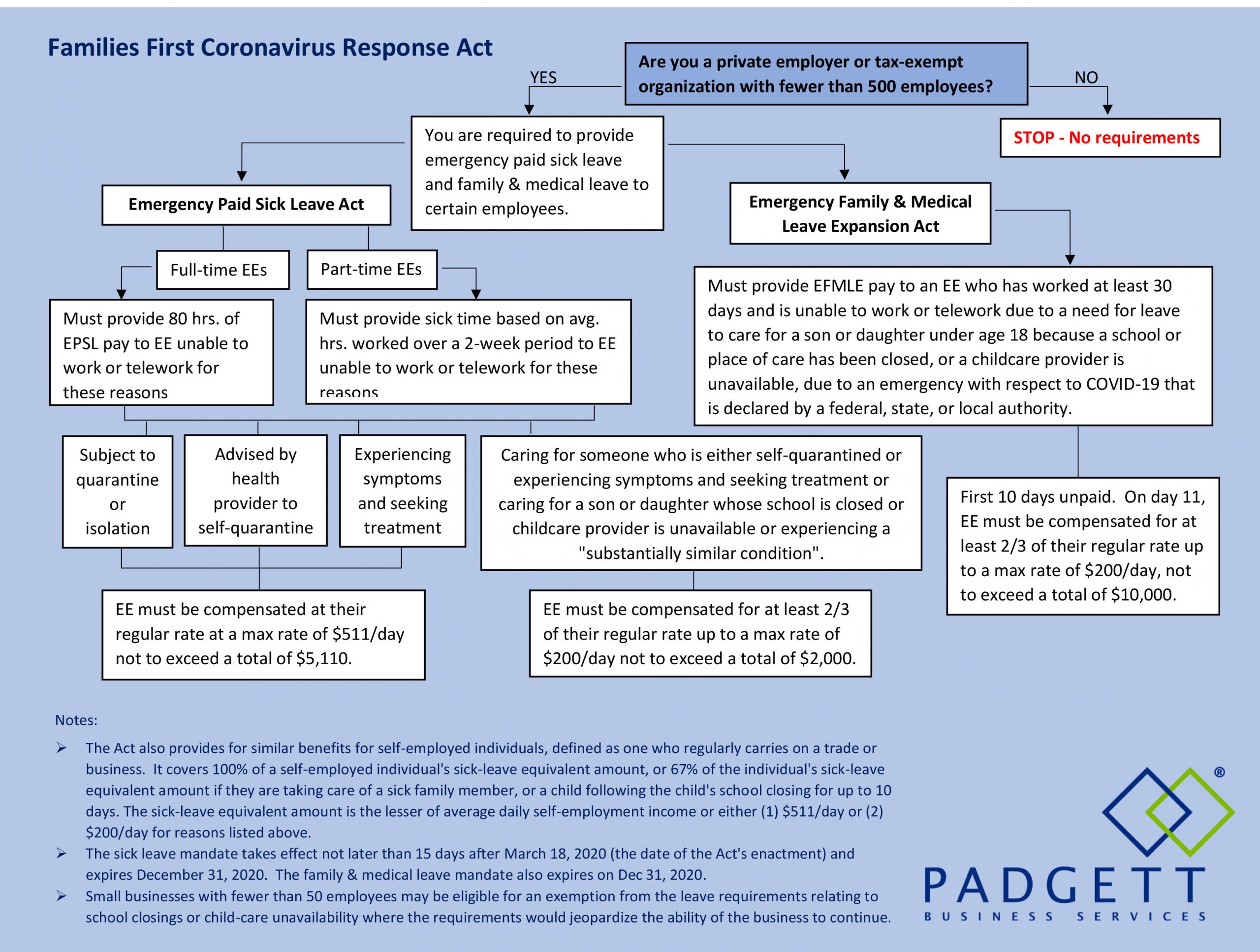

On April 1, 2020 your business is required to offer Sick and Family Medical Leave pay to qualifying employees.

You are required to print and display or otherwise distribute this Labor Poster to your workers to make them aware of this benefit.

How to determine who is eligible for benefits and which kind of benefit they qualify for? Click just below on the dark blue underlined link, it is an easy to understand flow chart that will assist you.

Emergency Sick and Family & Medical Leave Pay Flow Chart

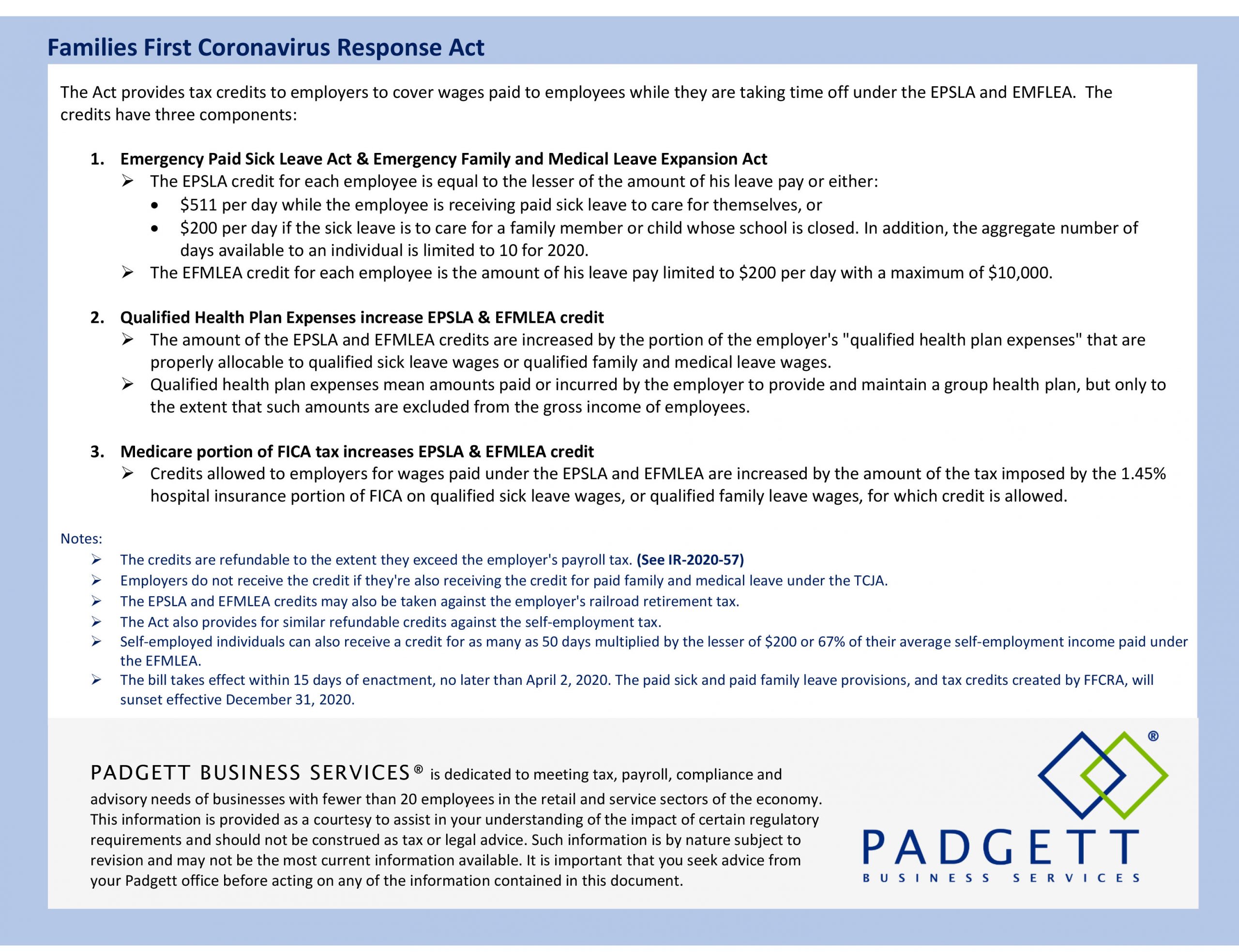

Paying Sick and Family Medical Leave in 2020 is FREE to your business!

Please remember that you pay these benefits and then you are reimbursed 100% through payroll tax credits on your 941 Form so the government is relying on YOU to pay your staff to keep them working if work is available, and then reimbursing you 100% to do so. You will have to keep track of this pay to receive the credit on your 941 payroll tax filings. The IRS is still working on changing the 941 filing forms and instructions to do so.

Get records from employees, for evidence that they qualify, and save the records:

Under the Emergency Paid Sick Leave Act, it is our further general understanding that employees should have proof of their ‘symptoms’ (COVID-19) or reason of ‘subject to isolation’, etc. Which would indicate that it is against their will to work. This should be by outside government agencies or medical professionals (the documentation/evidence should be in writing as well — not from the employee). Remember, you will be receiving these funds paid to employees 100% from the government (through payroll tax credits), so you may need documentation of proof later of why the employees qualified for this “free” pay that was paid for by the government. Keep those records!

Interpretation of the definitions found in this flow chart document, or other wage law specific questions, should be answered by your HR professional or attorney that specializes in wage law.

For more detailed questions, a great FAQ is found here:

Understanding Sick and Medical Leave Requirements due to COVID-19

OUR VIRTUAL TAX PREPARATION OPTIONS

Virtual business and individual tax preparation options are available with our award-winning tax team at Unbehagen Advisors. See more here:

Virtual Tax Preparation Options (Option #1 and #2): Click Here.

Our Secure Client Portal System (ShareFile) Click Here.

SMALL BUSINESS TAX & ACCOUNTING SERVICES

We provide small businesses with bookkeeping, financial reporting, tax, payroll, consulting and planning services. We have won many tax and accounting industry awards through our affiliation with Padgett Business Services.

Contact us today for a complimentary consultation to learn more about what GREAT things that we can do for you and your business!

727-934-7759 in**@***************rs.com

COMPLIMENTARY INSURANCE REVIEW

Now is the time to make sure you are not overpaying insurance premiums and are not properly insured. Take the time you have now and invest it in a complimentary insurance review with our affiliates at Wallace Welch & Willingham (Unbehagen Insurance). They have been serving Florida for over 90 years. Contact Matt MacMahon today. mm*******@****************ce.com 727-522-7777 ext 168 — www.UnbehagenInsurance.com

FURTHER COVID-19 UPDATE INFORMATION

We will be keeping you updated on small business and individual stimulus changes and tax changes during these times as it pertains to COVID-19. There are a lot of different opinions and commentary online about the stimulus that will be coming out soon. We will not provide speculation, rather we will only provide facts as soon as they are available. So, we will continue to proactively send out information as it becomes finalized and real. We will do so via these newsletters, on our website link for COVID-19 resources and information and on our Facebook page.

Our staff at Unbehagen Advisors is committed to advising you and your business. We appreciate your support of our firm — Since 1992.

_______________________________________________________________________________

Sorry, the comment form is closed at this time.